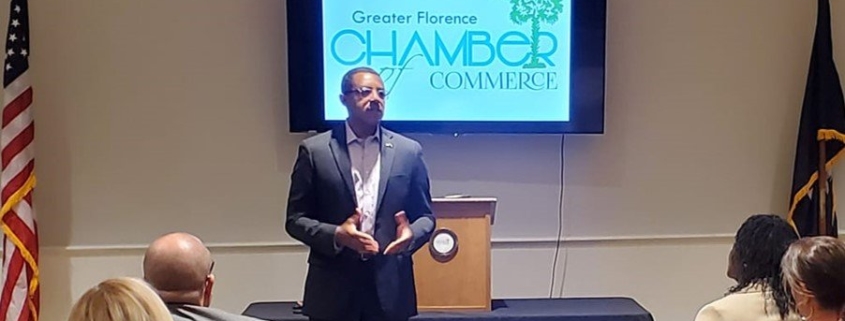

New Wave Tax Solutions Hosts Ribbon Cutting

A ribbon cutting was held on Wednesday, June 15th at New Wave Tax Solutions LLC celebrating its membership in the Greater Florence Chamber of Commerce. Joining owner Kandace Washington were family and friends, staff and Chamber ambassadors. The tax service is at 1801, Suite D, W. Evans St. in Florence.

New Wave Tax Solutions LLC is minority owned and operated, Washington said. “We specialize in individual and small-business taxes,” Washington said. “We provide tax assistance to our clients throughout nine states. We believe in keeping our clients informed and educated throughout the year on recent updates or changes to tax laws. Our services are rendered with integrity and at an affordable rate to all. We pride ourselves in providing the best tax solutions to meet the needs of our clients.”

Washington has assisted people throughout the United States for seven years with tax preparation. She has been employed in the finance industry since 2015 in South Carolina.

To read the full story, click here.